Mr. Luis Arredondo Malo

Chairman

Dear Shareholders:

Once again, as we present our annual report, I would like to take the opportunity to express our sincere thanks for the trust that you continue to place in Árima.

These past twelve months have been immensely important for our Company, a year in which we have laid the foundations for our short to mid-term future. Our active management and carefully selected investments have allowed us to make remarkable progress in terms of value creation for our stakeholders and underline our steadfast commitment to delivering on the strategy and the objectives set out when we first embarked upon this project in 2018.

We have also achieved excellent recognition for our sustainability performance, one of the cornerstones of our portfolio, successfully improving our ratings in the most acclaimed certifications and ensuring our portfolio offers exactly what is required by the market.

Our tangible initiatives further enhance Árima’s positive impact on society, and our ESG approach is based on balance – aiming to achieve continued economic growth by caring for both our future and the future of our environment.

As shareholders, you form an intrinsic part of all our achievements and as such, our aim is that this report will offer you a deeper insight into Árima and our management, presenting a transparent and in-depth account of all the aspects we consider relevant from 2021.

With your continued support, we will build on our success, continuing to maximise the value uplift offered by our portfolio thanks to our solid financial position and our team’s expert capacity to identify and capitalise on high-potential opportunities.

Yours faithfully,

+

Luis López de Herrera-Oria

Chief Executive Officer

Dear Shareholders:

Firstly, allow me to begin by extending my sincere thanks to our Chairman, the members of the Board and all our shareholders for their invaluable support and collaboration throughout this past year, as well as to everyone who plays an active part in the daily success of Árima.

Without doubt, 2021 has been a key year for the Company, and one in which we have reaffirmed Árima’s unwavering commitment to its strategy and its success.

By year-end, our portfolio has grown to €344 million – up by a magnificent 25% – thanks to the expertise of our team in creating and managing unique opportunities. As a result, EPRA NTA stands at €11.9 per share, up 23% since the Company’s IPO in 2018.

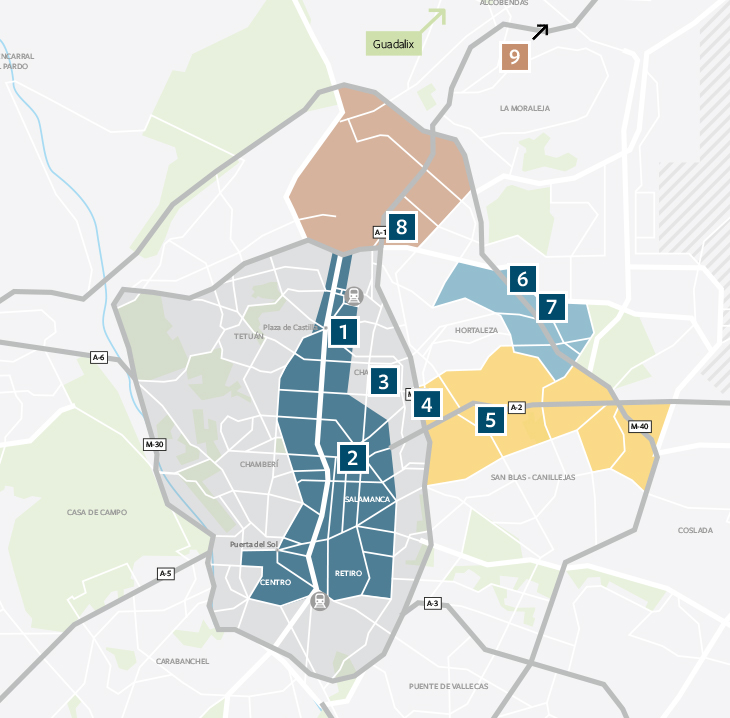

With half of the portfolio undergoing refurbishments, we expect our revenue to increase significantly over the coming years, with the current figure standing at €26 million. Our strong liquidity position and low leverage (currently 4.6% net LTV) are a solid base for identifying the best opportunities in the market and creating projects with strong value uplift potential in the near term.

Pre-letting 100% of the Habana building prior to completion of refurbishment works has allowed us to create an outstanding property for the tenant and secure excellent contractual terms and conditions for the Company. We have also successfully completed new acquisitions to expand the complex Pradillo operation in a further demonstration of our ability to identify unique opportunities offering formidable growth potential.

Since its creation, Árima has positioned itself as a benchmark in the market for quality and sustainable office spaces and is deeply committed to all environmental, social and corporate governance related matters via which we can generate a positive impact that sets us apart. This approach has been recognised by prestigious institutions in the sector, such as EPRA (European Public Real Estate Association), which has granted us its Gold award – the highest recognition in its Sustainability Best Practices category. GRESB (Global Real Estate Sustainability Benchmark) also rated us above our peer group companies, assigning us 85 points out of 100 and four stars in the comprehensive ESG performance evaluation.

As we embark on this next year, we are fully committed to continuing to build a value-add portfolio for all our stakeholders, capitalising on both our past experience and our ambition and drive for the future.

My warmest regards to you all,

+ Luis López de Herrera-Oria

Luis López de Herrera-Oria

Chony Martín Vicente-Mazariegos

Chony Martín Vicente-Mazariegos

Carmen Boyero-Klossner

Carmen Boyero-Klossner

Guillermo Fernández-Cuesta

Guillermo Fernández-Cuesta

Fernando Arenas

Fernando Arenas

Stuart W. McDonald

Stuart W. McDonald

Fabio Alén Viani

Fabio Alén Viani

Pablo de Castro

Pablo de Castro