Mr. Luis María Arredondo

Chairman

Dear Shareholders:

After our first full year, would like to convey our deepest gratitude for the trust placed in Árima.

It has been a very intense year, a year in which we have succeeded in making excellent real estate investments that form a solid and balanced portfolio with attractive returns and considerable value potential.

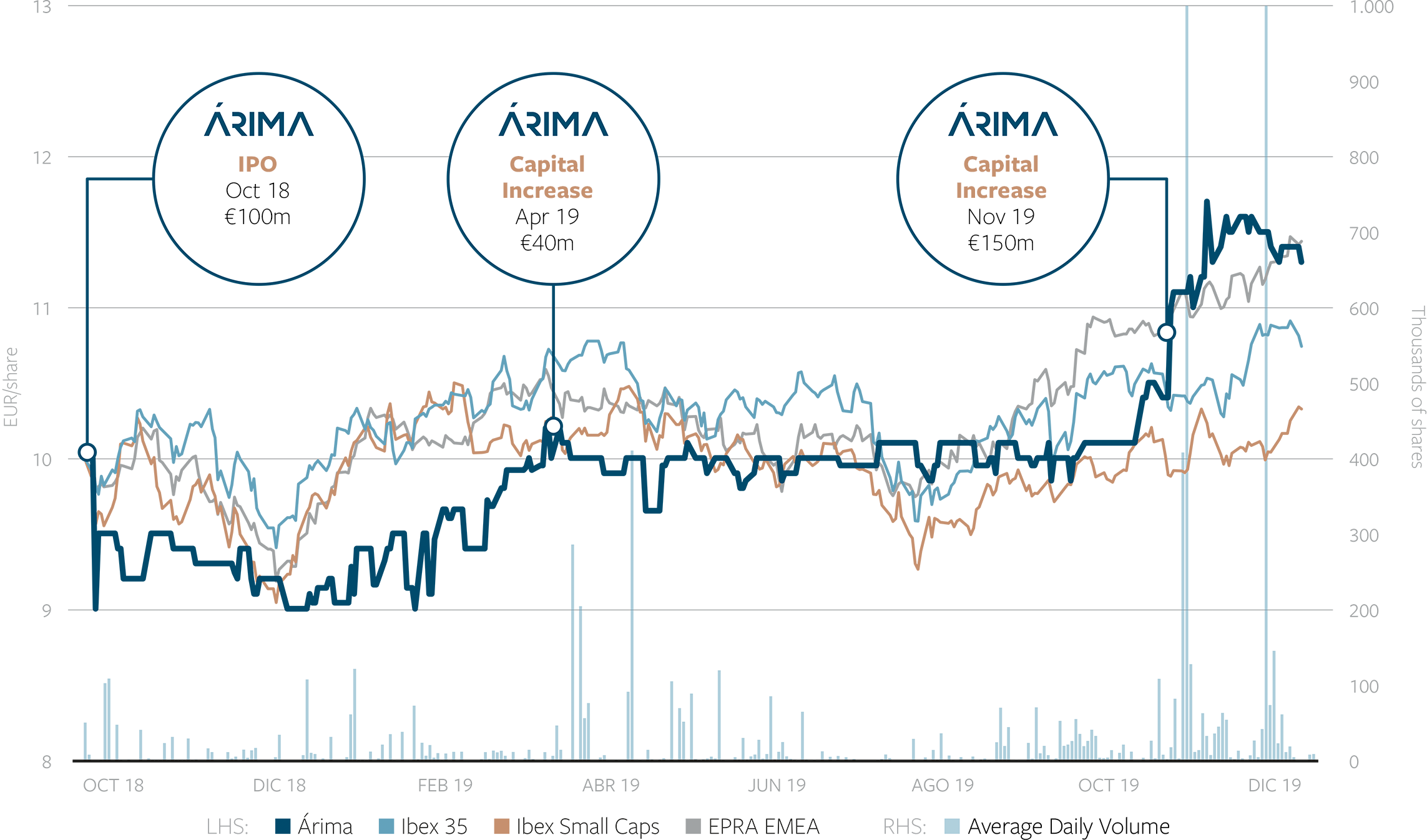

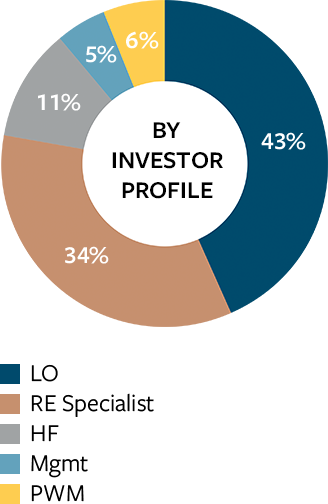

It has also been a year in which we have returned to the capital markets, carrying out two capital increases allowing us to triple the size of the Company since we were first listed on the stock exchange and, in turn, incorporating the prestigious, international shareholder of reference, Ivanhoé Cambridge.

Árima is a company with sufficient capacity and experience to source, select and invest in properties that —following rigorous management— become benchmarks in the real estate market thanks to their architectural and environmental quality.

We are privileged and proud to have you as shareholders. I encourage you to join us on this journey, in the knowledge that our primary focus is to create value for you.

Yours faithfully.

Luis Alfonso López de Herrera-Oria

Chief Executive Officer

Dear Shareholders:

First of all, please allow me to echo the words of our Chairman, whom I would like to thank, —along with our other Directors— for his constant support and cooperation during this extremely intense and rewarding period.

As you know, at the end of 2018, we floated the company on the basis of a rigorous business plan and the proven experience of a management team that I know well, having worked with them previously.

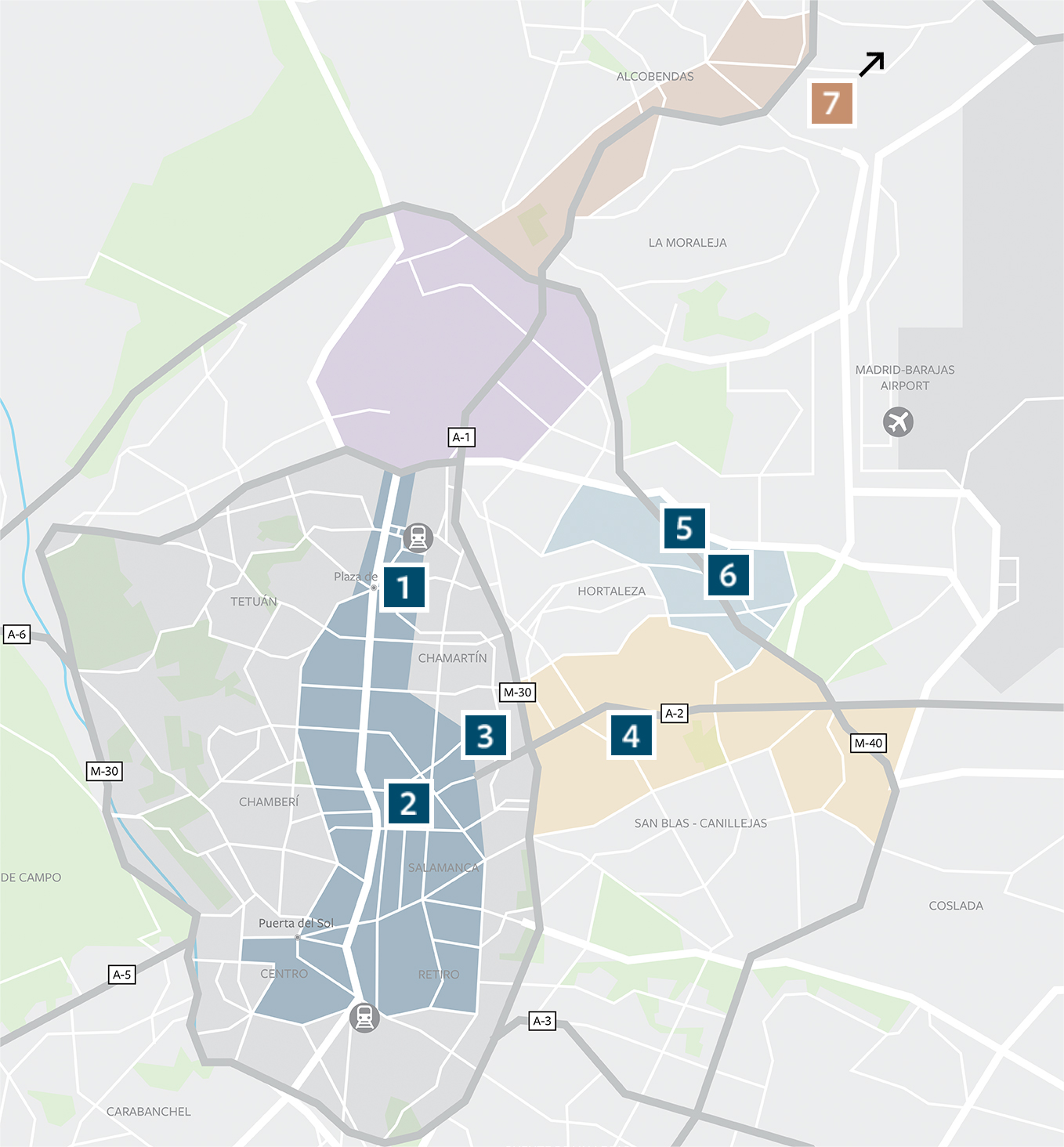

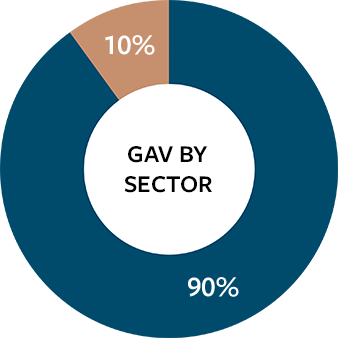

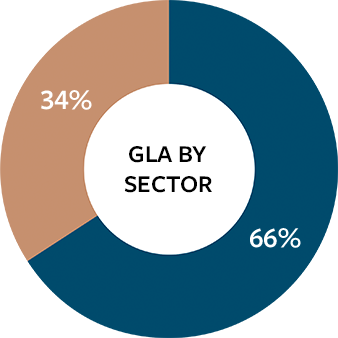

After just over a year, our portfolio is valued at €222 million. During these months we have focused on the identification and selection of the best properties, acquiring assets at very competitive prices, yielding attractive returns for our shareholders, coupled with a significant value add potential.

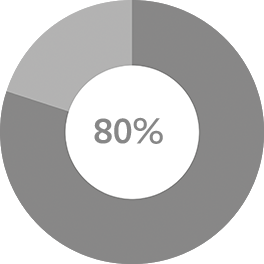

The close of the financial year has confirmed —through the valuation— the strength of our portfolio, with an increase of 16% over the purchase price. The refurbishment projects scheduled are fulfilling agreed requirements to be completed within 12-15 months.

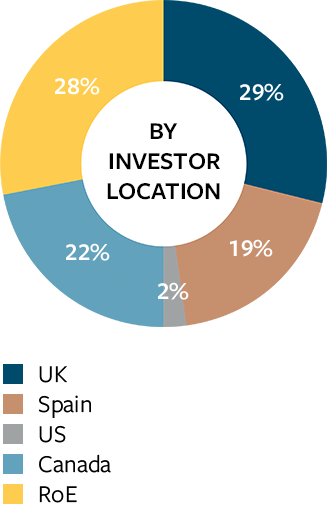

During 2019 we have carried out two capital increases, tripling the initial size by an additional 190 million euros and incorporating Ivanhoé Cambridge as the reference shareholder in the Company, we thank them for the faith shown in the portfolio and the team.

At the end of the year, we have reached an EPRA NAV of 10.6€/share, an increase of 10% since our IPO. The profit obtained during the year amounted to 15.4 million euros, which corresponds to a 1.05 euro per share.

With a view to 2020, the Company is very conscious of the pandemic and its impact. We will therefore continue to be consistent and prudent in our decision-making. We will place heavy emphasis on the diligent management of our portfolio, on refurbishment programmes and on the acquisition of new assets that fulfil our key vision of value creation for our investors.

Finally, I would like to highlight the fact that these achievements have been made within the framework of our commitment to transparency, integrity and good governance. A corporate responsibility commitment that is based on close collaboration with our shareholders, partners and tenants, so that we can make our company a unique asset, founded on the experience of the past and with its sights set on the future.

My best regards to you all.